You can filter to easily find the blogs most relevant to you.

Clear All

post

Do I Qualify for an Offer in Compromise? Here’s How to Know

Top 5 Common Bookkeeping Mistakes (and How to Avoid Them)

An Essential Guide to Tax Planning for Business Owners

Tax Extensions 101: Your Guide to Extending Your Tax Filing

Tax Preparation for Business Owners

DIY Taxes No More: When to Call in the CPA Cavalry for Your Small Business

When to Outsource Accounting and Payroll for Your Small Business

Subscribe to our Newsletter

Stay up to date with our latest insights.

Tax Loss Harvesting: A Guide to Cutting Your Tax Bill

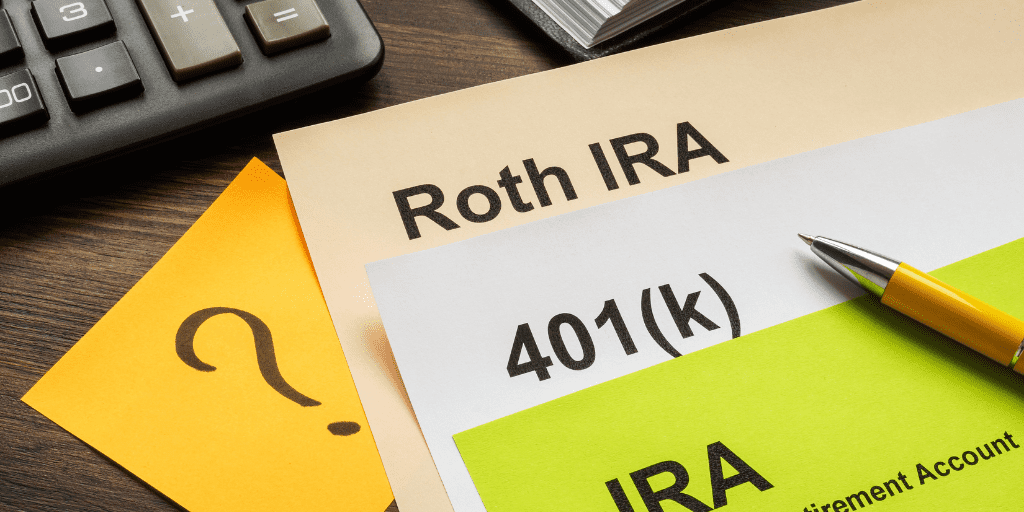

Should You Convert to a Roth IRA? Understanding Roth Conversion Rules

Load more